Why Hall Effect Joysticks Are Trending Among Gamers

Learn about why hall effect joysticks are trending among gamers in this comprehensive guide. Discover insights, tips, and information about why hall effect joysticks are trending among gamers.

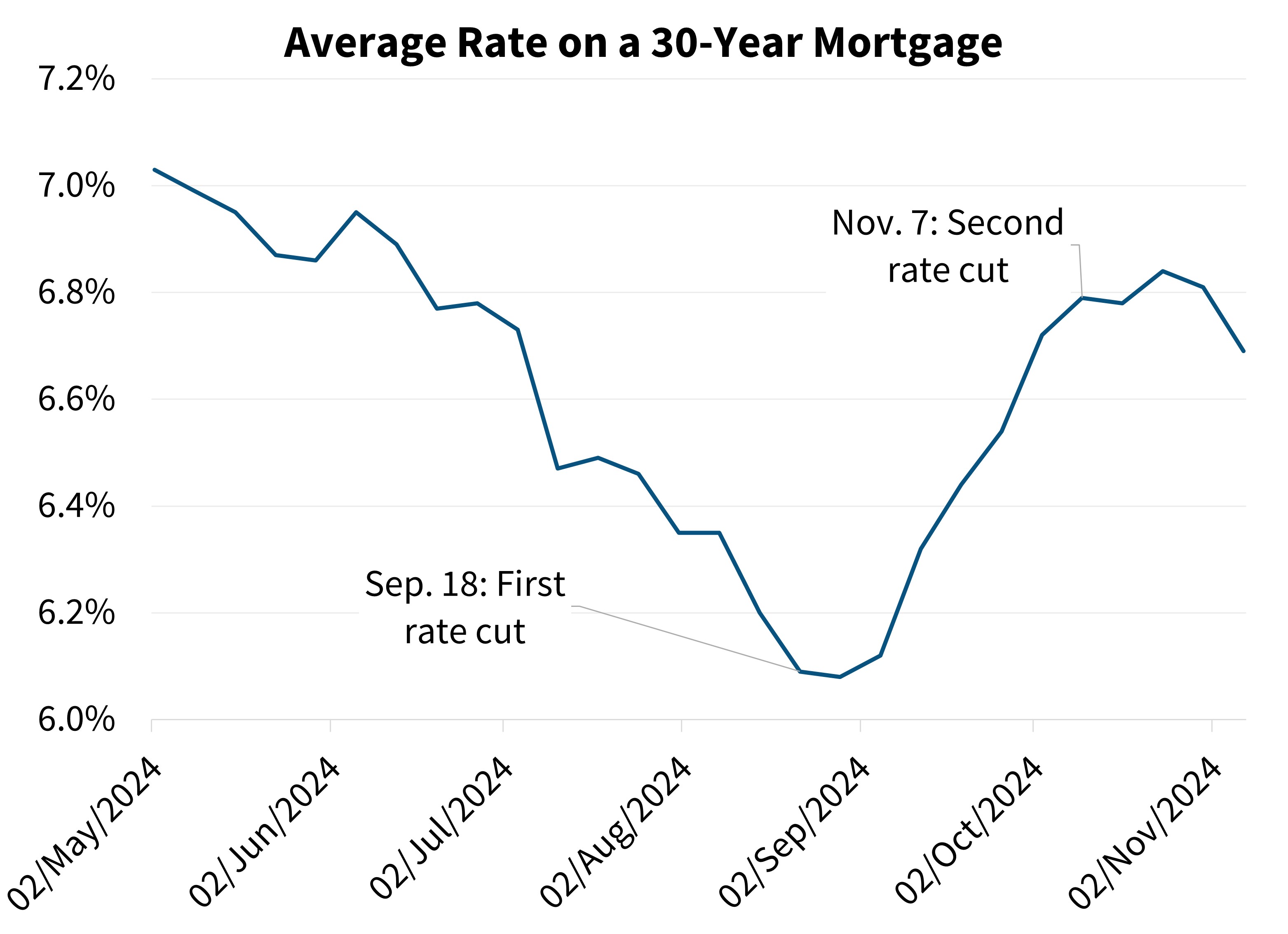

On October 30, 2025, the Federal Open Market Committee (FOMC) voted to cut the federal funds rate by 25 basis points — the first reduction since 2024. Here's what that means in practice. This highly anticipated decision reflects the Fed’s. Strategy to support economic growth amid easing inflation pressures and signs of a cooling but resilient labor market. This ‘October 2025 monetary policy’ shift follows months of speculation, with investors, economists, and mortgage holders closely tracking Chair Jerome Powell’s language during press conferences. See the section How the Rate Cut Affects Mortgage Rates below for borrower implications.

Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions. > Compliance note: Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions. > Compliance note: Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions. > Compliance note: Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions. > Compliance note: Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions. > Compliance note: >. Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions. > Compliance note: Health Disclaimer: is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. > Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions.

Compliance note: Health Disclaimer: This article is for informational purposes only and is not medical advice. Always consult a qualified healthcare professional for personal guidance. Finance Disclaimer: Educational content only. This is not financial advice. Please consult a licensed professional for decisions.

Learn about why hall effect joysticks are trending among gamers in this comprehensive guide. Discover insights, tips, and information about why hall effect joysticks are trending among gamers.

Learn about why carbon-plated running shoes motivate athletes in this comprehensive guide. Discover insights, tips, and information about why carbon-plated running shoes motivate athletes.

Learn about what are nicotine pouches and how are they used? in this comprehensive guide. Discover insights, tips, and information about what are nicotine pouches and how are they used?.

Learn about top features to look for in magnetic power banks in this comprehensive guide. Discover insights, tips, and information about top features to look for in magnetic power banks.

Learn about the rise of romantasy in modern storytelling in this comprehensive guide. Discover insights, tips, and information about the rise of romantasy in modern storytelling.

Learn about the power of immersive experiences in modern culture in this comprehensive guide. Discover insights, tips, and information about the power of immersive experiences in modern culture.